Table of Content

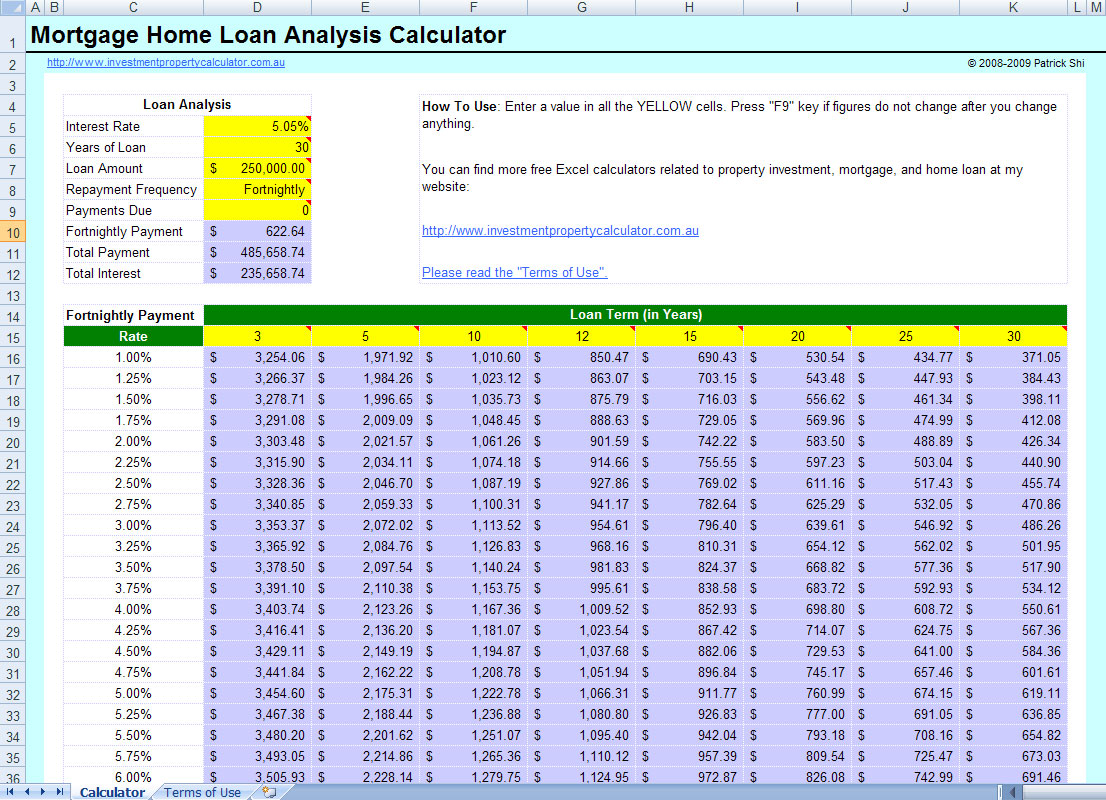

Be sure to weigh your options -- and speak with a financial professional -- before you decide. An annual fee of up to $90 may apply after the first year and is waived with a U.S. First is the draw period, followed by the repayment period.

While the aforementioned information has been collected from a variety of sources deemed reliable, it is not guaranteed and should be independently verified. We make it easy to access your approved line of credit with a VISA credit card. We are here to help you with answers to common questions about everything from membership to our products and services. Contact our experts today to review your home value, learn about your credit score, plan your budget, and craft your plan of action toward financial freedom.

Fast Track Short-Term Refinance

We invite you to use our commenting platform to engage in insightful conversations about issues in our community. We might permanently block any user who abuses these conditions. As of June 15, 2022, comments on DenverPost.com are powered by Viafoura, and you may need to log in again to begin commenting. If you need help or are having issues with your commenting account, please email us at Colorado borrowers are leading the nation for the size of home equity loans they are making this year, according to LendingTree.

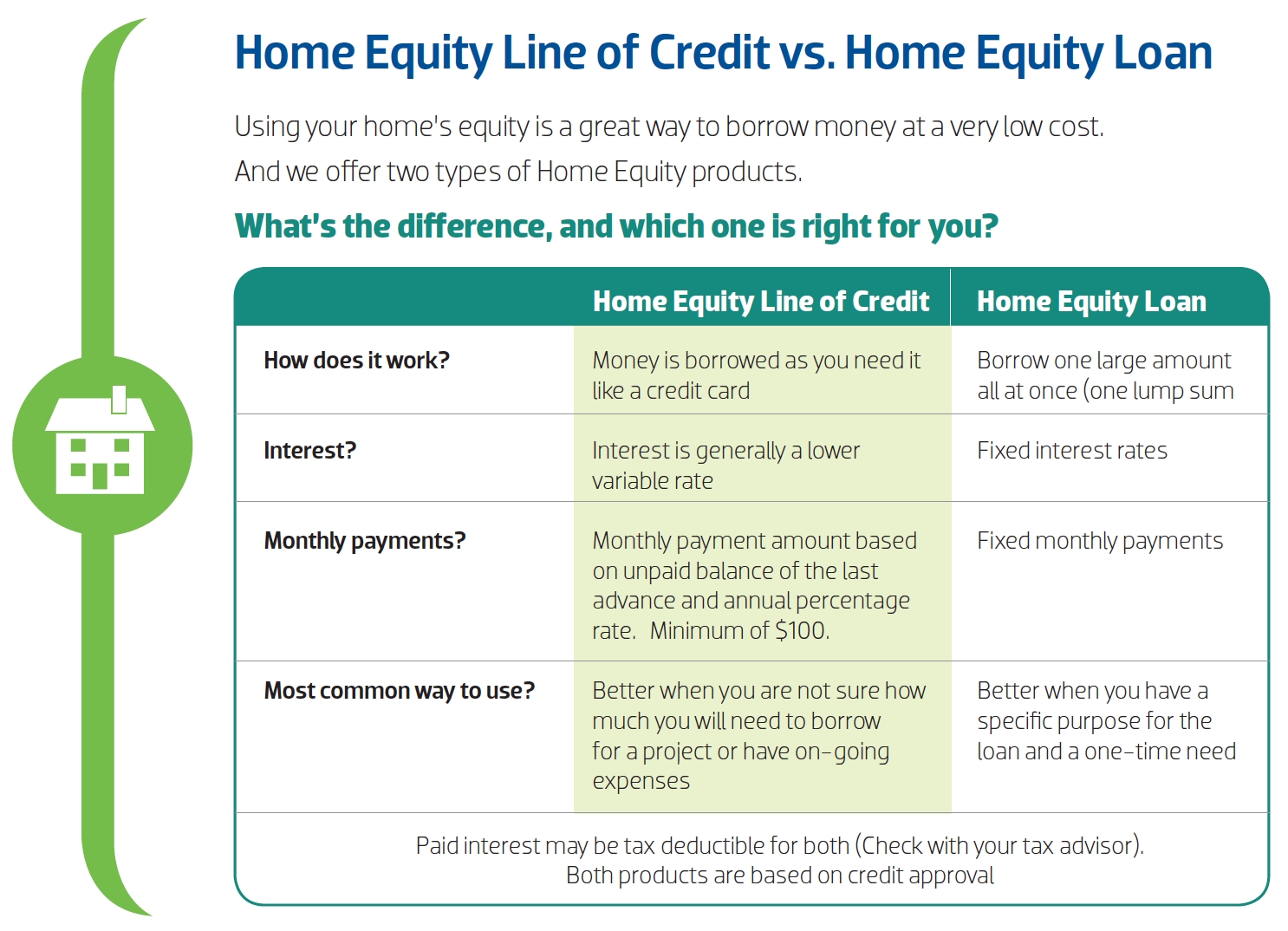

You won’t have to pay an annual fee for a home equity loan or HELOC with Connexus, but closing costs can range from $175 to $2,000 depending on your loan terms and property location. The Figure Home Equity Line is an open-end product where the full loan amount will be 100% drawn at the time of origination. The initial amount funded at origination will be based on a fixed rate; however, this product contains an additional draw feature. As the borrower repays the balance on the line, the borrower may make additional draws during the draw period.

Home Equity Line of Credit

If you’re an existing KeyBank customer, you’ll have the option to skim through the application and import your personal information from your account. Based in Cleveland, Ohio, KeyBank has been around for nearly 190 years. KeyBank offers home equity loans to customers in 15 states and HELOCs to customers in 44 states.

Interest Rates – Typically have lower interest rates than other types of loans. But you've got the knowledgeable WalletHub community on your side. Other consumers have a wealth of knowledge to share, and we encourage everyone to do so while respecting our content guidelines.

Third Federal Savings and Loan

Their mortgage experts provide round the clock service, and will not hesitate to provide any advice or information as requested from a borrower. APR of 4.99% will result in 36 monthly payments of $29.42 for every $1,000 borrowed. Streamlined Approval Process For Denver homeowners looking for quick financing, home equity loans are secured debts and offer a simpler and quicker approval process than many other loan options.

They are borrowing half as much as consumers in the rest of the country. The information contained on this website is provided as a supplemental educational resource. Readers having legal or tax questions are urged to obtain advice from their professional legal or tax advisors.

Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information. NextAdvisor may receive compensation for some links to products and services on this website. Lenders who are based in your area are more likely to understand the nuances of your local market and might offer services that are streamlined for Colorado borrowers.

A Home Equity Loan is best when you know the exact amount you’ll need and the length of time you’ll need it. A Home Equity Loan allows you to lock in a fixed rate with a consistent monthly payment over a set period of time, and your interest rate never changes. So, if a variable rate makes you nervous, a fixed-rate Home Equity Loan might be the way to go. We like PNC Bank because its application is straightforward and the bank is very transparent about its rates, fees, and terms without requiring a credit check. Though PNC doesn’t don’t offer home equity loans at all, its wide nationwide availability for HELOCs is noteworthy.

We help future and current homeowners make sense of things, free. Currently, Boulder is one of the priciest places to buy a home in Colorado, with a median home listing price of $825,000. This is almost twice the statewide median listing price of $415,000. Denver, the state's capital and largest city, is also somewhat pricey, with a median listing price of $475,000 and a median sale price of $407,200.

You qualify for a certain amount and draw on it as you need and pay back the amount in payments like you would a credit card. A Home Equity Loan or Home Equity Line of Credit is a great way to put your home’s equity to work for you. Home equity is the difference between how much you owe on your mortgage and how much your home is worth. A home equity line of credit allows you to tap into the equity of your home for emergencies, debt consolidation, vacations, home repairs and more. © 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved.

You could also find certain lenders that have more flexible underwriting criteria, and they could be a good backup option to consider if you’re not able to get financing elsewhere. Home equity loans and HELOCs with Third Federal come with an annual fee of $65 but no application fees, closing fees, or origination fees. If you set up autopay from an existing Third Federal account before closing, you’ll be eligible for a 0.25% rate discount. KeyBank HELOCs come with an annual fee of $50, but no closing costs unless your closing is performed by a closing agent. KeyBank offers a 0.25% rate discount for clients who have eligible checking and savings accounts with KeyBank. Additionally, home equity loans have an origination fee of $295.

The company prides itself on being able to navigate even the most complex of mortgage transactions with ease, and their clients are more than willing to attest to that fact. Bay Equity Home Loans was founded back in 2007 as a full-service mortgage lender, with an extra emphasis on service. With locations across 32 states, the company is still growing to this day, thanks to their fierce dedication to their trade. The good folks over at New American Funding know how to give people a great mortgage experience. For first time home buyers, their commitment to providing affordable home financing is nearly unrivaled.

Of course, low rates aren’t the only factor to consider when looking for home equity loans in Denver. No matter what the market says or how it’s performing, it’s essential to look into the reputation of the lender and make sure you’re borrowing money from a trustworthy source. Our picks for the best mortgage lenders in Colorado may not necessarily represent the best lender for your financial situation, goals, and desires. Everyone’s story is unique, and sometimes the best mortgage terms can be found in the most obscure places. As far as Colorado VA financing goes, originating these loans for such an experienced team is more like a walk in the park.

No comments:

Post a Comment